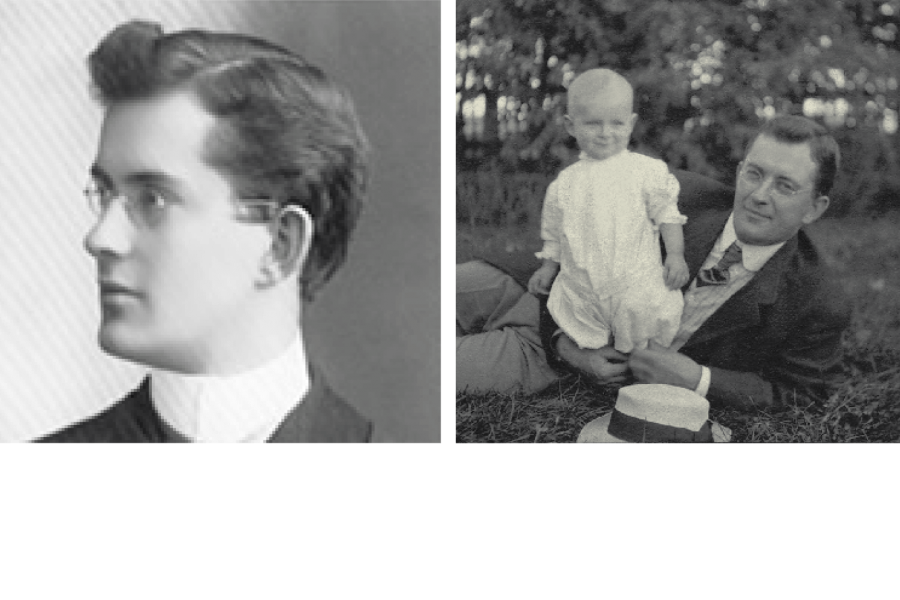

Dr. L.A.H. Warren The Warren Centre was created in honour of Lloyd A. H. Warren, the founder of the actuarial program in Manitoba. Warren was born November 18, 1879 in Balderson, Ontario. He graduated from Queen's University in 1902 with a Master of Arts degree and obtained his PhD from the University of Chicago in 1913. He joined the Faculty at the University of Manitoba in 1910 as an instructor of mathematics. In 1931, Warren was appointed professor of mathematics. In 1935, Warren became the first professor of actuarial science in Manitoba. Warren was also a fellow of the American Institute of Actuaries (1935), fellow of the Actuarial Society of America (1939), fellow of the Casualty Actuarial Society and fellow of the Royal Astronomical Society. As a consulting actuary, Warren helped to establish the pension fund for teachers in Winnipeg schools.

Warren was a Past Member of the Assiniboine Lodge, A.F. and A.M. and a 32nd degree member of the Ancient and Accepted Scottish Rite of Freemasonary. Warren was a devout churchgoer. He filled many offices in St. Luke's Church and at the time of his death was a lay delegate to the General Synod of the Church of England in Canada.

He died in Winnipeg on October 7, 1949.